|

To the Editor:

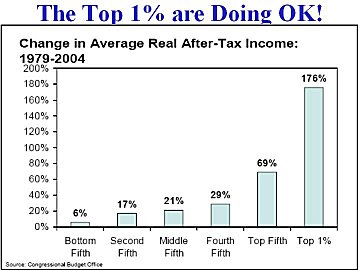

That statement shouldn’t be too surprising as it is what’s happening in the US in general. And for many, the re-distribution is going in the wrong direction…a very disturbing direction. The embedded graphic sourced from the Congressional Budget Office (CBO) shows the data:

The data suggests that over the last twenty-five years the top 1% of the US wage earners after-tax income has gone up about 176% (about 7% per year). The top 20% of US wage earners went up 69% over the same twenty-five tears. The same can’t be said for the other 80% of the population.

That data shows that the average after-tax income for 80% of the population went up 29% total or less (or just a little over 1% per year.) That isn’t very much of an average after-tax income increase over a 25-year period. That obviously includes the middle class…or whatever there is left of it. That average increase wouldn’t even handle minimum inflation, and there hasn’t been just minimal inflation. Is there any wonder that a lot of people are feeling a lot of financial stress?

Notice that the data is from 1979 to 2004. Care to guess what the data looks like from 2004 to 2010? Care to guess who got the bulk of the recent bailout money and what was done with it?

Care to guess who will get the bulk of the next bailout money? And who will pay for it?

Of course the numbers should be challenged. Maybe somebody misinterpreted the CBO data. It is possible. It is also possible that there is something very wrong, financially speaking, with the US.

This isn’t an attack on very wealthy people. Many movie, sports, business and media celebrities make millions of dollars because they can fill theaters, stadiums, shopping malls and broadcast venues. It could be said that this group of people make money the old fashioned way – they earn it and create jobs. This can’t be said for the small group of corrupt businesses that should be under a microscope.

This is an attack on people who steal other people’s money through the process of corruption. There are many recent examples of corruption coming from a very small group of businesses on Wall St.

It is alleged that a large Wall St business was approached by a Hedge Fund to produce an investment vehicle named Abacus that would fail. This was done, sold to pension funds around the world and the result is history. The Hedge Fund made a $1 billion and so did the seller. When the story broke, the Wall St investment firm settled out of court for an alleged $500 million fine with no admission of guilt or wrongdoing. Pretty much routine for the 5-6 largest Wall St firms as they go about their business.

That same Wall St firm is alleged “to flash trade, front-run and illegally naked short-sell securities.” It is said on Wall St that a “receding tide exposes all those swimming without suits.” We shall see!

This corruption also transcends both political parties – they are both guilty. Clinton initiated many of the steps that allowed this to happen on Wall St. The large Wall St business wasn’t even a commercial bank – it was an investment bank. It was allowed to become a commercial bank so that it could be bailed out with taxpayer money. When are taxpayers going to become really upset with this?

Your and my grandchildren co-signed the loan to bail out these few corrupt banks. Unpayable Debt?!

Residents everywhere need to take a look at this corruption if there is ever going to be any tax relief!

I just thought

that you had a “Right to Know (R2K).

Ivan

Beliveau

Goffstown

|