|

To the Editor:

There may be mortgage fraud in New Hampshire. It’s not the garden variety “ha-ha I got a $500K home loan and I don’t even have a job.” It’s not the garden variety “ha-ha I took your $500K home loan, packaged it with a bunch more just like it, insured them with AIG, sold them all over the world, made a fortune and got bailed out at taxpayers expense when it all collapsed.” It is an intentional fraud being orchestrated, at some level, right now with the home foreclosure process.

This is a breaking national story. There may be an opportunity right now to help a resident who may be in the process of having a home illegally foreclosed, or who may have already had a home illegally foreclosed. It would be very smart to research this story as it may “have legs” and consequences.

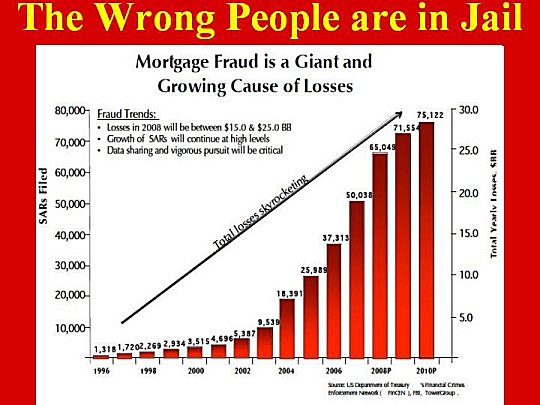

The graphic below shows the growing magnitude of the home mortgage foreclosure fraud. The data is from Federal Bureau of Investigation Suspicious Activity Reports (SARs.) Holy smokes!

This is basically what is happening: Normally when a home or car is sold there must be a “clean title.” This is pretty basic because sometimes a lien is attached to a home title to collect on some unpaid bill. To insure that there is a “clean title,” there needs to be a “title search.” In legal terms, this is called “Perfection of Title.” This keeps legal types busy, employed and the rest of us protected.

In NH, the legal types go to Nashua and do a routine title search. However, this is not the process that was followed for some mortgage titles, especially those since 2005 with Fannie Mae and Freddie Mac.

This is about those banks that went around this process to save time and money. These banks registered their mortgages without a title search with a private mortgage registry company – Mortgage Electronic Registration Services (MERS.) The question, simply stated, is who owns the home title? No legal title, no legal foreclosure! It might be a good idea to ask a lawyer type about what is happening. There is also information available on the Internet to help learn what is happening.

The best way to grasp this may be this 7 minute, 49 second video. Watch it! This seems balanced.

http://www.informationclearinghouse.info/article26507.htm

Just to be clear, this is not about small, local banks and credit unions that actually hold mortgages.

This story is breaking out all over the Internet as the “plot thickens.” There are many good articles.

http://www.rawstory.com/rs/2010/10/bank-america-halts-foreclosures-23-states/

http://www.opednews.com/populum/print_friendly.php?p=SHOCK-THERAPY-FOR-WALL-STR-by-Ellen-Brown-101003-838.html

Perhaps there will be time in the future to analyze what went wrong.

Right now the focus needs to be on local residents and how they can be alerted so that they can protect their home and families from a possible fraud. What will you do to possibly help your neighbors?

It might not be a bad idea to talk to them and ask them if they are aware of this breaking story.

I just thought that you had a “Right to Know” (R2K.)

Ivan

Beliveau

Goffstown

|