|

To the Editor:

Goffstown school and town budgets have been doubling for a long time. Looking at past town reports or other technical sources can substantiate that fact.

Several people have observed recently that increasing town and school budgets doesn’t always mean higher property taxes. State and federal government money in recent years has had a positive impact on local tax rates. There are several observations that can be made concerning the impact of “government money” on property taxes.

First, there is no such thing as “government money.” It is taxpayer money! Go look in a mirror and see one of those taxpayers. The fact that governments tax, borrow money from other countries and use photocopier money still has a big impact on the person in the mirror. Think about it.

A second and immediate observation is a way to totally remove local property taxes. Let the state and federal government pay everyone’s property taxes…Seriously, why not? Cajole, beg or demand that someone else “pick up the tab.” Ultimately, that someone else still lurks in the mirror.

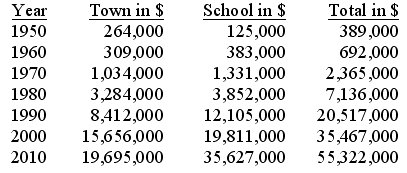

The third observation about Goffstown’s property taxes is that budgets in Goffstown keep rising for whatever reason. Some fairly recent data follows:

|

Goffstown’s Total Budget by

Decade |

|

|

Since 1950, the town population has tripled and the number of students has gone from 564 to over 3,000. These facts alone don’t account for the spectacular increase in the total Goffstown budget.

For some, going back to 1950 is irrelevant. Others will accurately point out that some of the increase in the above data is due to inflation. Others will say that it is only the last 5 years’ data that counts. Some may observe that in the last 5 years unanticipated revenues from sources outside Goffstown have lowered final property taxes. Maybe these sources will continue…perhaps not.

The key question is what about the next 5 years, 10 years or more. No one knows about the future for sure. However, a future like the last 5 years is possible…perhaps not. Maybe a future more like the last 60 is just around the corner…perhaps even much sooner…if the impact of inflation (hyperinflation!) is considered. Maybe it is wise to anticipate a worst-case scenario…maybe not.

It is true that there will be consequences, good or bad, for whatever actions are taken. The town’s total budget and/or taxes may double. The future and voters actions will decide that outcome!

If the town’s total budget and/or taxes are set to double, for any reason, in the next 10 years, then a level-funded budget will require, in effect, a 50% reduction leading into 2020. Think about it.

Ivan Beliveau

Goffstown

|