|

March 5,

2010

School

Board gave false tax rate information to The Goffstown News

$610,000

suddenly "missing" from Budget Committee's tax

rate calculation; Chairman Cloutier demands explanation, names of individuals responsible

By

GUY CARON

GOFFSTOWN

- On March 4th, The Goffstown News published an article

on the upcoming March 9th Town Vote (see "Town, school tax rates concern voters").

The article quotes tax impact figures related to the

school district that were provided to writer Sarah

LeBrun by SAU business

administrator Ray Labore.

As a member of the Budget Committee, I immediately

noticed a gross discrepancy between what The Goffstown

News reported both in the article, and in a related

editorial, and what I new to be factual information

about the record tax increase that's about to hit us

all.

The article quoted the school district's claim that the

difference between the proposed school budget and the

default budgets was only $0.14 per $1,000 of assessed

value. The FACT is that the difference is actually

$0.57 per $1,000. Having scrutinized the school

budgets for months while on the Budget Committee, I know

this to be true.

SAU business administrator Ray Labore also told the Goffstown News that meant an

increase of only $35.00 on a $250,000 home. The

FACT is, the increase is actually going to be $142.50, not

a mere 35

bucks.

That evening, Budget Committee Chairman Dan Cloutier

also noticed the inaccurate tax rates quoted in the

article and initiated an email to Labore, copied to

School Board Chairman Keith Allard and the rest of the

Budget Committee. In that email, and the series of

emails that followed, Cloutier is asking some pointed

questions, none of which have been answered by either

Labore or Allard as of this posting.

CLICK

HERE TO READ THE EMAIL EXCHANGES BETWEEN CLOUTIER AND

ALLARD.

ANSWERS NOT FORTHCOMING

Allard's only response so far on the school board's

actions has been to provide two spreadsheets to defend

the tax rates provided to The Goffstown News. But

when looking at these spreadsheets, $610,000 from the

Budget Committee's tax impact calculation, presented at

public hearing on January 6th, is MISSING.

The number has been deleted.

This convenient - and inaccurate - omission makes the

school tax rate, and the difference between the proposed

and default budgets, appear much smaller than they

actually are.

INTENTIONAL OR ACCIDENTAL? Decide for yourself.

So why

did the school district provide the inaccurate and

misleading figures to The Goffstown News?

One explanation can be construed in Keith Allard's

continued public attempts to sway voters into voting in

the default school budget, which is $803,254 higher than

the proposed budget. He has made no secret of his

attempts to do this. By falsely claiming only a

small difference between the two, he hopes the sway

taxpayers into voting for the default budget by making

them think the difference is minor. It is not.

He even went so far in the same Goffstown News article

as to say, “Maybe the community will vote in the default budget and we won’t have to make cuts (within the

district)”.

It is clear that the school district's submission of

false information to The Goffstown News misleads

taxpayers into voting "No" on school article

2.

Cloutier seems to think the same as well. In his

emails to Allard and Company, he states directly: "...the provider of this information has just informed the taxpayers that if they do not vote for article 2, their tax rate will go up only $.14 per thousand when in fact it is estimated to increase by another $.43 or a total of $.57 per thousand.

The impact of supplying this false information for a $250,000 assessment is not $35.00 as printed in the paper but three times that for an additional $107.50 to come to an accurate projection of $142.50.

This is not the best we can do and is a disservice to the voters who are looking to their elected officials and the people they hire to provide accurate and unbiased

information."

DEMAND FOR ANSWERS

As a member of the Goffstown Budget Committee, and

as a taxpayer, I call upon Keith Allard and SAU 19

Superintendent Stacy Buckley to ANSWER the questions

that were put forth to them today by our chairman Dan

Cloutier.

I also call upon all Goffstown residents to demand an

explanation for this blatant attempt by Allard, Buckley

and the rest of the school board to intentionally

deceive the taxpayers by falsifying the Budget

Committee's tax impact analysis for their own

gain.

Cloutier's unanswered questions, at the time of this

posting, are:

-

Who is responsible for the calculation provided?

-

Who approved its release?

-

Why is the $610,000 of estimated use of unreserved fund balance missing from the calculation of the Budget Committee tax rate on the spreadsheet provided to us today and the information provided to the Goffstown News?

It's

time Goffstown's taxpayers got answers to these

questions, and more importantly, REMOVE every individual

who may have been involved in this obvious, intentional

attempt to deceive us all. Allard and Buckley can

be reached as follows:

And

before you call either of them, feel free to contact

Budget Committee Chairman Dan Cloutier at AlphaOmegaNH@comcast.net

for more information.

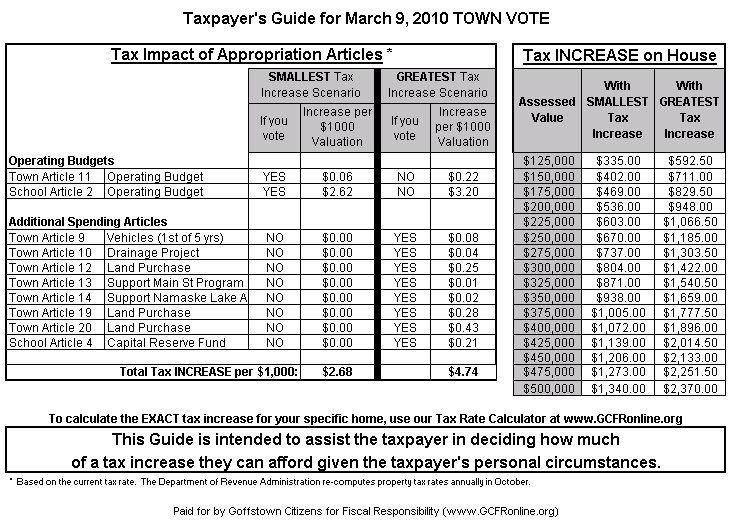

Want to know

how your vote on certain articles will REALLY affect your

personal taxes?

Click on the link below to use our calculator.

2010 Tax Rate

Calculator

or

Right-click

here to download to your computer

Copyright©2010,

Goffstown Residents Association. All Rights

Reserved.

|